I suspect that the answer lies in inertia. People get used to whatever situation they are in, and any change to that is unfamiliar and breeds resistance. In the case of celebrities and money, they get used to the "celebrity lifestyle," spending exorbitant sums on limousines, fine food and clothing, and expensive homes, vehicles, and toys. If their income does not continue to support these activities, then a larger and larger percentage of their income becomes consumed with merely maintaining the appearance of the celebrity lifestyle.

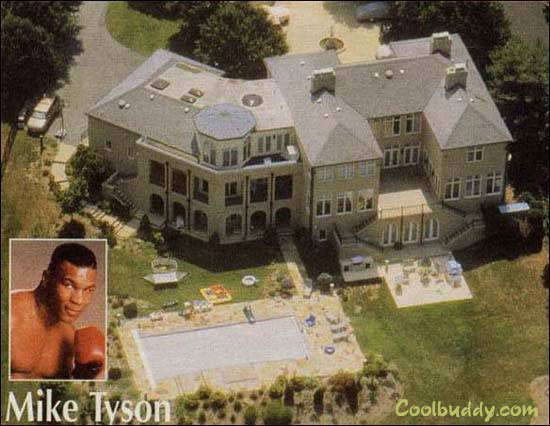

Mike Tyson's Former House:

Sadly, this problem is mirrored in our federal government. The political elite has become so used to the endless spending of their own celebrity lifestyle, that they simply can't imagine anything else. Let's look at it through a personal finance analogy...

A person has two types of income: "total income" and a "disposable income." In the case of the United States, the total income is essentially the GDP (Gross Domestic Product) -- the value of all the goods and services produced by the US economy in a single year. This number is currently estimated for 2008 at $14.33 trillion, a large number to be sure. Our "disposable income" can be thought of as tax revenue; this is the money not in use for the essential purposes of operating businesses, producing goods, keeping people fed, etc. Current federal tax revenue for the US is in the neighborhood of $2.66 trillion, or about 18.5% of GDP. This is probably a similar disposable to total income ratio to most households in the United States.

So with $2.66 trillion not needed to just keep the lights and heat on, our spending limits should be quite clear. Ideally we'd spend less than that so we could put some money aside for a rainy day, but of course that is not the case. The current federal budget is in the neighborhood of $2.9 trillion. Hmm. As you can see, we're already adding about 9% of our disposable income to our deficits each year. Like any household budget, there are three ways to deal with this: lower your spending, increase your income, or go into debt. Like any good celebrity we have chosen the last, in the form of treasury bond issues through the Federal Reserve.

But it's worse than that. The above just relates to the annual operational debt we are incurring, and does not include "unfunded liabilities." These are expenses analogous to mortgage and car notes for a family, ongoing longer term expenses that can't be dodged and for which we simply don't have the revenue. The two big offenders here are the Medicare and Social Security programs. How big are these liabilities? The numbers are a little vague because they depend on what period of time you look at and how rosy or grim your revenue projections are. But virtually nobody believes they are less than $50 trillion.

Let me repeat that. $50 trillion. 50,000,000,000,000 dollars. That is the equivalent of every dollar made in the United States economy for 3.5 years. And that is the minimum projection, some analysts see that number as closer to $100 trillion. It is obvious that the only way to financially survive this crushing debt is to go on a crash program of economic development and radical spending cuts. We need to cut up the credit cards and stop eating at the Four Seasons.

But Congress is addicted to the celebrity lifestyle, and the inertia of extravagant spending. So rather than grow the economy, Congress proposes "Cap and Trade" legislation, which amounts to a tax on economic development which trickles down to every person in the nation as higher energy prices and increased cost of all goods, since all goods require energy to produce. This is like quitting your high paying job and taking a lower paying job when you are snowed under in credit card bills.

Congress also wants to pass a new Universal Healthcare bill. The cost? Anywhere from one to two trillion dollars over ten years. In other words, increase annual spending, just on this one program, by up to ten percent. That's like taking out a loan for a new luxury home when you have an empty bank account and negative income.

Kingsmill Resort & Spa, Site of Congressional Retreat:

This cannot continue. I don't mean that in the moral sense, I mean it in the economic sense. As much as they would like to, Congress cannot repeal the laws of economics. We cannot keep printing money (the money supply has been doubled by the Fed/Treasury since Obama took office) and not devalue the currency. This angers our creditors, because the value of the bonds they hold is lessened. More importantly, it reduces the value of every dollar held by every American. Expect increased inflation soon, and some are predicting "hyperinflation" with rates of inflation going as high as 10% per month. This is not your father's economy (though it may be your grandfather's, if he lived through the Great Depression).

What to do? Well, currently cash is king. First get out of as much personal debt as possible, yesterday. Interest rates will continue rising, and personal debt will become an expensive anchor dragging you down. Second, keep as much cash reserve as you can. The markets are very volatile right now, so be conservative if you choose to stay in them. If the inflation rate really starts climbing, you might want to get out of the cash as well, and move into gold or silver. Once inflation gets high enough, cash value will erode fast enough that hanging on to dollars simply degrades your assets faster than having something of real value.

I wish I had better news, but since we are acting like celebrities we have to take up the celebrity mantra: "You have to pay if you want to play."

No comments:

Post a Comment